What is accounting firm CRM?

Accounting firm CRM (customer relationship management) software is a tool that helps accounting firms manage their relationships with clients and prospects. It provides a centralized platform for tracking client interactions, managing marketing campaigns, and generating reports. Accounting firm CRM software can help firms improve their efficiency, productivity, and profitability.

Importance and benefits of accounting firm CRM

Accounting firm CRM software is important for a number of reasons. First, it helps firms track client interactions and manage marketing campaigns more efficiently. This can lead to improved client satisfaction and increased revenue. Second, accounting firm CRM software can help firms generate reports that can be used to identify trends and improve performance. Third, accounting firm CRM software can help firms automate tasks, such as sending out invoices and reminders. This can free up staff time so that they can focus on more important tasks.

Main article topics

- Benefits of accounting firm CRM software

- How to choose the right accounting firm CRM software

- Best practices for using accounting firm CRM software

Accounting Firm CRM

Accounting firm CRM software is a valuable tool that can help firms improve their efficiency, productivity, and profitability. By providing a centralized platform for tracking client interactions, managing marketing campaigns, and generating reports, accounting firm CRM software can help firms gain a competitive edge.

- Client Management: Track client interactions, manage marketing campaigns, and generate reports.

- Marketing Automation: Automate marketing tasks, such as sending out invoices and reminders.

- Sales Pipeline Management: Track the progress of sales opportunities.

- Customer Service: Provide excellent customer service by tracking and resolving client issues.

- Reporting and Analytics: Generate reports that can be used to identify trends and improve performance.

- Integration: Integrate with other business applications, such as accounting software and email marketing platforms.

- Security: Protect client data with robust security features.

By implementing accounting firm CRM software, firms can gain a number of benefits, including:

- Improved client satisfaction

- Increased revenue

- Improved efficiency

- Increased productivity

- Improved profitability

If you are an accounting firm that is looking to improve your efficiency, productivity, and profitability, then accounting firm CRM software is a valuable tool that you should consider implementing.

Client Management

Client management is a critical component of accounting firm CRM. By tracking client interactions, managing marketing campaigns, and generating reports, accounting firms can gain a deep understanding of their clients’ needs and preferences. This information can then be used to provide personalized service and build stronger relationships.

For example, an accounting firm might use its CRM system to track the following information about its clients:

- Contact information

- Service history

- Billing information

- Marketing preferences

This information can then be used to:

- Segment clients into different groups based on their needs

- Create targeted marketing campaigns

- Provide personalized service

- Generate reports that can be used to improve the firm’s performance

By using a CRM system to manage client interactions, accounting firms can improve their efficiency, productivity, and profitability.

Marketing Automation

Marketing automation is a key component of accounting firm CRM. By automating marketing tasks, such as sending out invoices and reminders, accounting firms can free up their staff to focus on more important tasks, such as providing excellent customer service.

-

Improved efficiency

Accounting firms can improve their efficiency by automating marketing tasks. For example, an accounting firm might use its CRM system to automatically send out invoices and reminders. This can free up staff time so that they can focus on more important tasks.

-

Increased productivity

Accounting firms can increase their productivity by automating marketing tasks. For example, an accounting firm might use its CRM system to automatically generate marketing campaigns. This can help the firm to reach more potential clients and generate more revenue.

-

Improved profitability

Accounting firms can improve their profitability by automating marketing tasks. For example, an accounting firm might use its CRM system to track the effectiveness of its marketing campaigns. This information can then be used to improve the firm’s marketing ROI.

By automating marketing tasks, accounting firms can improve their efficiency, productivity, and profitability.

Sales Pipeline Management

Sales pipeline management is a critical component of accounting firm CRM. By tracking the progress of sales opportunities, accounting firms can identify potential roadblocks and take steps to mitigate them. This can help to improve the firm’s sales conversion rate and increase revenue.

For example, an accounting firm might use its CRM system to track the following information about its sales pipeline:

- Contact information for potential clients

- Service needs

- Estimated closing date

- Probability of closing

This information can then be used to:

- Identify potential roadblocks

- Develop strategies to overcome roadblocks

- Forecast revenue

- Improve the firm’s sales conversion rate

By using a CRM system to manage its sales pipeline, an accounting firm can gain a competitive advantage. The firm can identify and close more sales opportunities, which can lead to increased revenue and profitability.

Customer Service

Providing excellent customer service is essential for any business, and accounting firms are no exception. In fact, customer service can be a key differentiator for accounting firms, as it can help them to attract and retain clients. Accounting firm CRM software can help firms to provide excellent customer service by tracking and resolving client issues.

- Responsiveness: Accounting firm CRM software can help firms to be more responsive to client inquiries and requests. By providing a centralized platform for tracking client interactions, accounting firm CRM software can help firms to ensure that no client falls through the cracks.

- Personalization: Accounting firm CRM software can help firms to personalize their interactions with clients. By storing client data in a central location, accounting firm CRM software can help firms to remember client preferences and provide them with tailored service.

- Proactive problem-solving: Accounting firm CRM software can help firms to proactively identify and resolve client issues. By tracking client interactions, accounting firm CRM software can help firms to identify potential problems before they become major issues.

- Feedback collection: Accounting firm CRM software can help firms to collect feedback from clients. This feedback can be used to improve the firm’s customer service and overall operations.

By providing excellent customer service, accounting firms can build strong relationships with their clients. These relationships can lead to increased client loyalty and revenue. Accounting firm CRM software can help firms to provide excellent customer service and build lasting relationships with their clients.

Reporting and Analytics

In the context of accounting firm CRM, reporting and analytics play a pivotal role in driving performance improvement and optimizing client service delivery. Accounting firm CRM systems offer robust reporting and analytics capabilities that empower firms to harness data and gain actionable insights into their operations and client interactions.

-

Performance Metrics Tracking:

Accounting firm CRM systems allow firms to track key performance metrics such as client acquisition cost, revenue per client, and client lifetime value. By monitoring these metrics over time, firms can identify trends and patterns that inform strategic decision-making. For instance, a firm may discover that a particular marketing campaign is generating a high volume of leads but low conversion rates. This insight can prompt the firm to refine its campaign strategy or explore alternative channels.

-

Client Segmentation and Analysis:

Accounting firm CRM systems enable firms to segment their client base into meaningful groups based on factors such as industry, size, or service needs. By analyzing each segment’s unique characteristics and behaviors, firms can develop tailored marketing campaigns, pricing strategies, and service offerings that resonate with each group’s specific requirements.

-

Resource Allocation Optimization:

Reporting and analytics in accounting firm CRM systems provide insights into resource utilization and efficiency. Firms can analyze data on staff workload, billable hours, and project profitability to identify areas where resources can be allocated more effectively. By optimizing resource allocation, firms can improve their overall productivity and profitability.

-

Client Satisfaction Measurement:

Accounting firm CRM systems facilitate the collection and analysis of client feedback. Firms can use surveys, feedback forms, and other tools to gather insights into client satisfaction levels, service quality, and areas for improvement. By analyzing this feedback, firms can identify common pain points and develop strategies to enhance the client experience.

In conclusion, reporting and analytics are essential components of accounting firm CRM, providing firms with the data-driven insights they need to improve performance, optimize client service, and gain a competitive edge in the market. By leveraging these capabilities, accounting firms can make informed decisions, allocate resources effectively, and deliver exceptional client experiences.

Integration

In the realm of accounting firm CRM, integration plays a pivotal role in enhancing efficiency, productivity, and client satisfaction. By seamlessly integrating with other business applications, accounting firms can streamline their operations, automate tasks, and gain a holistic view of their client interactions.

-

Enhanced Data Management:

Integration enables accounting firms to consolidate data from disparate systems, such as accounting software, email marketing platforms, and customer support tools. This centralized data repository provides a comprehensive view of client information, including financial data, communication history, and service requests. With real-time data synchronization, firms can make informed decisions based on up-to-date information.

-

Automated Workflows:

Integration allows firms to automate repetitive tasks and streamline workflows. For instance, invoices generated in the accounting software can be automatically sent to clients via email marketing platforms, eliminating manual data entry and reducing the risk of errors. Automated workflows improve efficiency, free up staff time for value-added tasks, and enhance client responsiveness.

-

Personalized Marketing Campaigns:

Integration with email marketing platforms empowers accounting firms to create personalized marketing campaigns tailored to each client’s unique needs and preferences. By leveraging data from the CRM system, firms can segment their audience, track campaign performance, and deliver targeted messages that resonate with clients. Personalized marketing campaigns nurture relationships, increase engagement, and generate higher conversion rates.

-

Improved Client Collaboration:

Integration with collaboration tools, such as project management software or file-sharing platforms, facilitates seamless client collaboration. Firms can share documents, track project progress, and communicate with clients in real time. This enhanced collaboration fosters transparency, improves communication, and strengthens client relationships.

In conclusion, integration is a cornerstone of accounting firm CRM, enabling firms to unlock a wealth of benefits. By integrating with other business applications, accounting firms can streamline operations, automate tasks, gain a comprehensive view of client data, and deliver exceptional client experiences. Embracing integration empowers firms to stay competitive, increase efficiency, and drive growth.

Security

In the context of accounting firm CRM, security plays a critical role in maintaining the confidentiality, integrity, and availability of sensitive client data. Accounting firms handle a wealth of financial information, making them a prime target for cyberattacks. Robust security features are essential for protecting client data from unauthorized access, data breaches, and other threats.

-

Data Encryption:

Encryption is a fundamental security measure that protects data by converting it into an unreadable format. Accounting firm CRM systems should employ strong encryption algorithms to safeguard client data at rest and in transit, minimizing the risk of unauthorized access.

-

Access Controls:

Access controls restrict who can access client data within the CRM system. Firms should implement role-based access controls to ensure that users only have access to the data they need to perform their job functions. Multi-factor authentication can further enhance access control by requiring users to provide multiple forms of verification before accessing the system.

-

Audit Trails:

Audit trails system activities and user actions, providing a detailed history of who accessed or modified client data. This information is crucial for detecting and investigating security incidents, ensuring accountability, and complying with regulatory requirements.

-

Regular Security Updates:

Cyber threats are constantly evolving, so it’s essential for accounting firms to keep their CRM systems up to date with the latest security patches and updates. Regular updates address known vulnerabilities and enhance the overall security posture of the system, reducing the risk of successful attacks.

Robust security features are not just a compliance requirement but a business imperative for accounting firms. By implementing comprehensive security measures, firms can protect client data, maintain trust, and mitigate the financial and reputational risks associated with data breaches.

FAQs on Accounting Firm CRM

Accounting firm CRM (customer relationship management) software is a valuable tool that can help accounting firms improve their efficiency, productivity, and profitability. However, many firms have questions about accounting firm CRM before implementing it. Here are answers to some of the most frequently asked questions:

Question 1: What are the benefits of using accounting firm CRM software?

Accounting firm CRM software offers a number of benefits, including:

- Improved client satisfaction

- Increased revenue

- Improved efficiency

- Increased productivity

- Improved profitability

Question 2: How much does accounting firm CRM software cost?

The cost of accounting firm CRM software varies depending on the vendor and the features that are included. However, most accounting firm CRM software vendors offer a range of pricing options to fit the needs and budgets of different firms.

Question 3: What are the key features of accounting firm CRM software?

Key features of accounting firm CRM software include:

- Contact management

- Opportunity tracking

- Marketing automation

- Customer service management

- Reporting and analytics

Question 4: How do I choose the right accounting firm CRM software?

When choosing accounting firm CRM software, it is important to consider the following factors:

- The size of your firm

- Your budget

- Your specific needs

Question 5: How do I implement accounting firm CRM software?

Implementing accounting firm CRM software can be a complex process. However, most vendors offer implementation services to help firms get up and running quickly and efficiently.

Question 6: What are the best practices for using accounting firm CRM software?

Best practices for using accounting firm CRM software include:

- Use the software consistently

- Keep your data clean and up to date

- Use the software to automate tasks

- Use the software to generate reports

By following these best practices, accounting firms can maximize the benefits of their accounting firm CRM software.

Accounting firm CRM software is a powerful tool that can help accounting firms improve their efficiency, productivity, and profitability. By understanding the benefits, costs, and features of accounting firm CRM software, firms can make an informed decision about whether or not to implement this software.

Transition to the next article section

Accounting Firm CRM Tips

Accounting firm CRM (customer relationship management) software can be a powerful tool for improving efficiency, productivity, and profitability. However, getting the most out of your accounting firm CRM software requires careful planning and implementation. Here are five tips to help you get started:

Tip 1: Define your goals and objectives

Before you start using accounting firm CRM software, it’s important to define your goals and objectives. What do you want to achieve with the software? Do you want to improve client satisfaction? Increase revenue? Streamline operations? Once you know your goals, you can start to develop a plan for using the software to achieve them.

Tip 2: Choose the right software

There are many different accounting firm CRM software solutions on the market. It’s important to choose the software that’s right for your firm’s size, needs, and budget. Consider the features that are important to you and make sure that the software is easy to use and integrate with your other business systems.

Tip 3: Implement the software correctly

Once you’ve chosen the right accounting firm CRM software, it’s important to implement it correctly. This involves setting up the software, training your staff, and migrating your data. It’s also important to develop a plan for ongoing maintenance and support.

Tip 4: Use the software consistently

To get the most out of your accounting firm CRM software, it’s important to use it consistently. This means logging into the software regularly and using it to track your client interactions, manage your marketing campaigns, and generate reports. The more you use the software, the more valuable it will become.

Tip 5: Measure your results

It’s important to measure your results to see how your accounting firm CRM software is performing. This will help you to identify areas where you can improve your use of the software and maximize its benefits.

By following these tips, you can get the most out of your accounting firm CRM software and improve the efficiency, productivity, and profitability of your firm.

Conclusion

Accounting firm CRM software is a powerful tool that can help firms improve their efficiency, productivity, and profitability. By providing a centralized platform for managing client relationships, marketing campaigns, and reporting, accounting firm CRM software can help firms streamline their operations and gain a competitive edge.

Firms that are looking to improve their performance should consider implementing accounting firm CRM software. By following the tips outlined in this article, firms can get the most out of their accounting firm CRM software and achieve their business goals.

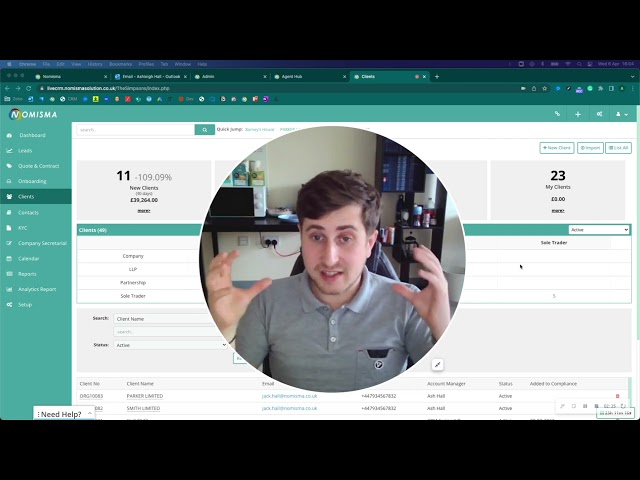

Youtube Video: